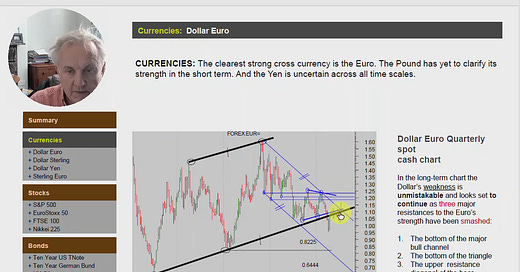

CURRENCIES: The most clearly strong currency is the Euro. The Pound has yet to clarify its strength in the short term. And the Yen is uncertain across all time scales.

STOCKS: The clear medium and long-term bullish resilience of these markets is striking but there so far is a lack of short-term pattern clarity in the US and Europe compared to the UK. Like the Yen chart the Nikkei is not at all clear.

BONDS: Trading ranges dominate the medium and long-term charts in the German and US charts. But note the bull yield chart (and bear price chart) patterns that are close to completion in the UK. And some interesting very short-term indicators are pointing to higher yields there as well

COMMODITIES: Oil's jump is dramatic and destroyed the immediate bear case. Note though, that the market is at the top of its short-term trading range. Gold has completed a short-term bull H&S pattern, despite having exhausted the bull energy of the long and medium patterns.

Mark Sturdy’s technical analysis over multiple time-frames across major World stock, bond, FX and commodity markets.

Subscribe to get the whole of Seven Days Ahead’s research across all the World’s Major Markets every week here:

https://sevendaysaheadtech.myshopify.com

Share this post